Forex trading has become increasingly popular over the years. With the rise of online platforms and the accessibility of trading tools, individuals from all walks of life are taking the plunge into currency markets. In this article, we will explore various aspects of trading in Forex, including strategies, essential tips, and insights into how to navigate this dynamic environment. If you’re looking to expand your trading knowledge, visit trading in forex trader-maroc.com to get more resources and explore this field deeply.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of currencies on a global scale. It is one of the largest financial markets in the world, with a daily trading volume exceeding $6 trillion. The primary goal of Forex trading is to profit from the fluctuations in currency exchange rates. Traders can register profits from both rising and falling markets, making Forex a versatile trading option.

Understanding Currency Pairs

In Forex trading, currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the base currency, while the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding currency pairs is crucial for traders as it impacts their trading decisions and strategies.

The Mechanics of Forex Trading

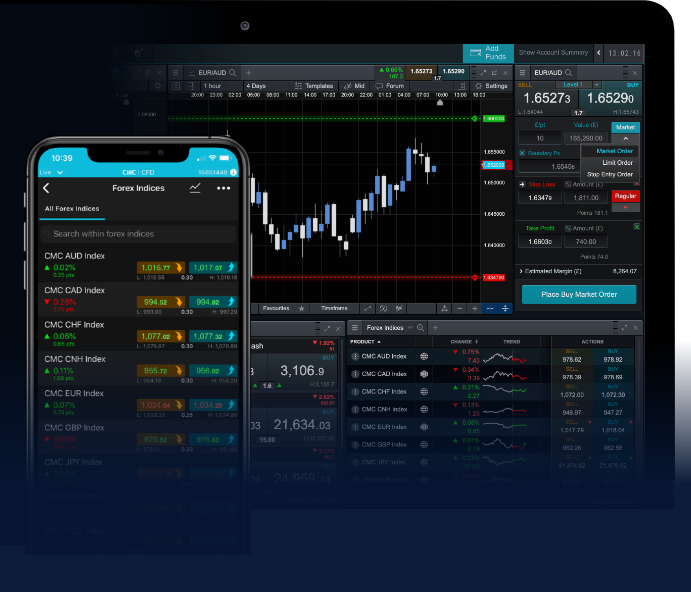

The Forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time. Unlike stock markets, which have specific trading hours, the Forex market is accessible around the clock due to the global nature of currency trading. The market is divided into major sessions – Asia, Europe, and North America. Each session has its own characteristics, which traders can leverage for optimal results.

Key Players in the Forex Market

The Forex market consists of several players, including central banks, financial institutions, corporations, and retail traders. Central banks play a significant role, as their monetary policies can impact currency values drastically. Financial institutions facilitate trades and provide liquidity, while corporations use Forex to hedge against currency risk. Retail traders, who are individuals trading from personal accounts, have increased in number significantly, thanks to the accessibility of online trading platforms.

Forex Trading Strategies

To succeed in Forex trading, traders often rely on specific strategies tailored to their risk tolerance and trading goals. Here are a few popular approaches:

- Day Trading: This strategy involves opening and closing trades within a single trading day. Day traders aim to take advantage of small price movements and often rely on technical analysis.

- Swing Trading: Swing traders hold positions for several days or weeks to capitalize on expected price swings. This strategy can be advantageous in capturing longer-term trends.

- Scalping: Scalpers make multiple trades throughout the day, aiming for very small price changes. This strategy requires a meticulous approach and a deep understanding of market indicators.

- Position Trading: Long-term traders who follow fundamental analysis typically use this strategy. They hold positions for months or even years, focusing on the overall direction of the currency pair.

Risk Management in Forex Trading

Effective risk management is essential in Forex trading. Due to the volatility of currency markets, traders must implement strategies to protect their capital. Some popular risk management techniques include:

- Setting Stop-Loss Orders: A stop-loss order automatically closes a position at a specified price, preventing further losses.

- Risk-to-Reward Ratio: Establishing a risk-to-reward ratio helps traders determine whether a trade is worth the risk. A common ratio is 1:2, meaning potential profits are twice the potential loss.

- Proper Position Sizing: Determining an appropriate position size relative to your account balance is crucial. Avoid risking more than 1-2% of your capital on a single trade.

Using Technical and Fundamental Analysis

Successful Forex trading often involves a combination of technical and fundamental analysis:

- Technical Analysis: This approach focuses on price charts and indicators to identify potential buy and sell signals. Traders use various tools, such as moving averages, trend lines, and oscillators, to make informed decisions.

- Fundamental Analysis: Fundamental analysis examines economic indicators, news events, and geopolitical factors that can impact currency values. Traders often analyze reports such as GDP, employment statistics, and interest rate changes to inform their trading decisions.

The Importance of Trading Psychology

Trading psychology plays a vital role in a trader’s success. Emotions can significantly impact decision-making, often leading to impulsive trades and errors in judgment. It’s essential to cultivate a disciplined mindset, focusing on a consistent trading plan and strategy. Moreover, maintaining emotional balance and resilience can help traders navigate the ups and downs of the market.

Conclusion

Forex trading offers vast opportunities for those willing to learn and adapt to the ever-changing market landscape. By understanding the fundamentals, employing sound strategies, and managing risk, traders can enhance their chances of success. Remember that continuous education and practice are key components of becoming a proficient Forex trader. Exploring resources like trader-maroc.com can provide valuable insights and education in your trading journey. Embrace the challenge, stay informed, and trade wisely.